The Golden Age of Gold: Insights from Trump’s Second Term Inauguration

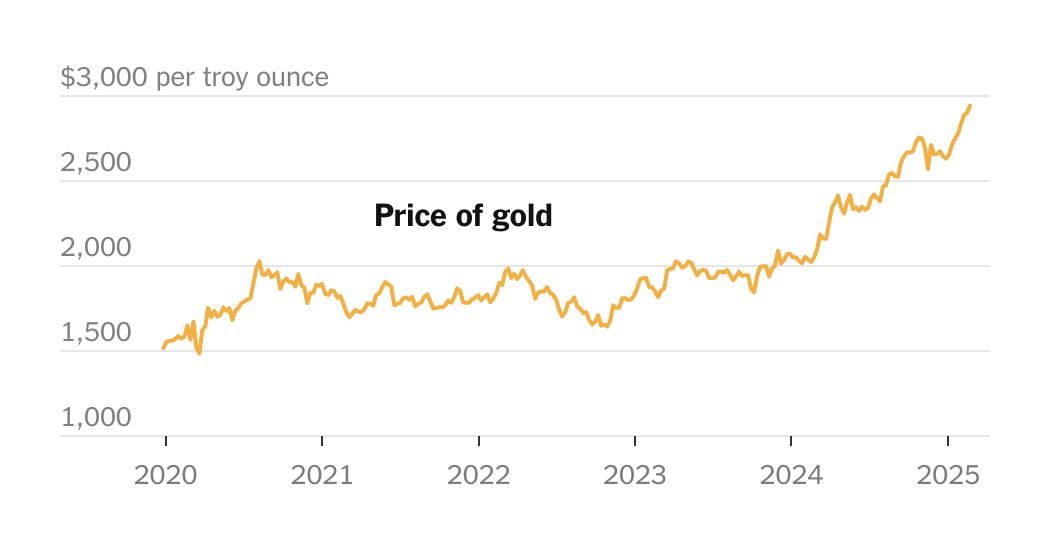

When President Trump declared at his inauguration that “the golden age of America begins right now,” he may not have meant it in the financial sense, but irony has surfaced as gold prices have reached historic heights. In what many financial analysts are calling a “gold rush,” the price of gold recently surpassed $2,900 per troy ounce, showcasing a striking increase of about 12% in just the first month of Trump’s second term, following a robust 27% rise the previous year. The recent surges and strategic forecasts hint at ongoing optimism among gold investors.

The Surge in Gold Prices

Gold has long been recognized as a safe-haven asset for investors seeking stability amid financial turmoil. Many turn to gold during uncertain times, as it historically maintains value when other markets falter. The current spike in gold prices may reflect investor sentiments towards financial insecurity, despite contrary indications in the stock market, where U.S. stocks are hitting record highs and the labor market remains resilient.

The simultaneous rise in both gold and stock markets is perplexing. Traditionally, when economic indicators showcase strength, gold tends to cool off. However, the current scenario draws more complex considerations, combining both optimism in the stock market with a strategic pivot towards gold as a hedge against looming uncertainties.

Demand Dynamics in the Market

The demand for gold has reached a fever pitch, particularly in New York, the global hub for futures trading. The rush has led to delays in delivering physical gold from vaults in London, underlining a fraying supply chain. This overwhelming demand is not merely indicative of investor behaviors; it suggests an underlying anxiety about future economic conditions.

Geopolitical tensions and inflation fears, fueled by President Trump’s potentially controversial policies regarding tariffs and immigration, have added layers of complexity to the market. Investors are expressing concerns that these policies might stoke inflation and exacerbate instability in international relations, influencing the growing shift towards gold. The association between gold and stability resonates deeply in such uncertain contexts, wherein physical assets gain appeal over volatile market equities.

Government Assurance of Gold Reserves

Interestingly, President Trump recently hinted at sending officials to Fort Knox, home to half of the U.S. Treasury’s gold reserves, to confirm the quantity of gold held there. This seemingly reactive measure—intended to reaffirm confidence in the nation’s gold reserves—was met with assurance from Treasury Secretary Scott Bessent, who affirmed that the gold was indeed secure. Such public declarations are symptomatic of the heightened concern over gold as a pillar of national economic strategy.

Navigating Inflation Fears

The complex interplay between current inflation expectations and gold prices has renewed discussions among investors. With the financial landscape shifting—thanks to uncertainties stemming from domestic policies and global economic anxieties—gold remains an attractive alternative. Many strategists are now recalibrating their forecasts, predicting potential gains for gold as both a hedge against inflation and a stabilizing force amid fluctuating markets.

As Trump continues to navigate his policies, experts will be closely watching how they affect inflation and international economies. Gold’s rise reflects not just a reaction to market trends but also embodies a collective sentiment of caution and strategy among investors.

Implications for Investors

The current financial environment offers a compelling case for why investors might be diversifying into gold. As they seek refuge from the inherent risks associated with stocks and the potential fallout from political dynamics, gold presents itself as a tried-and-true safeguard. The ongoing demand underscores not just technical trading strategies but also the deeply rooted psychological drivers shaping investment decisions.

This duality of hope in equity markets, coupled with fear of external shocks, will likely define the landscape for gold in the months to come. Investors are advised to approach this dynamic with a careful eye, considering both the risks and the potential rewards of this intriguing financial intrigue.

In essence, we are witnessing a storied narrative unfold—a narrative underscored by rising gold prices and the intricate dance between market optimism and the soothing promise of age-old investments. Gold, in this era, is becoming more than just a commodity; it is a beacon of confidence, guiding investors through murky waters of uncertainty.