SoftBank Acquires Ampere Computing for $6.5 Billion

On Wednesday, SoftBank Group Corp. officially announced its decision to acquire Ampere Computing for $6.5 billion. This strategic move underscores SoftBank’s intention to enhance its foothold in the rapidly evolving technology sector, specifically focusing on Arm-based chipsets that are increasingly relevant in data center operations.

Ampere’s Role in Data Centers and AI

The acquisition reflects SoftBank’s belief in the potential of Ampere’s chips, especially as the demand for artificial intelligence technologies skyrockets. Notably, Nvidia has dominated this arena, but SoftBank envisions Ampere contributing significantly to A.I. innovations.

Ampere Computing, founded eight years ago, focuses on delivering microprocessors tailored for data centers, utilizing technology developed by Arm Holdings, a company acquired by SoftBank in 2016. Masayoshi Son, the chairman and CEO of SoftBank, emphasized the pivotal role these chips will play in advancing artificial superintelligence, remarking, “The future of artificial superintelligence requires breakthrough computing power.”

A Wholly Owned Subsidiary

Post-acquisition, Ampere will operate as a wholly owned subsidiary under the SoftBank umbrella. This acquisition comes at a time of intense competition and collaboration within the semiconductor market, largely driven by the insatiable demand for chips that support A.I. applications, such as those powering OpenAI’s ChatGPT.

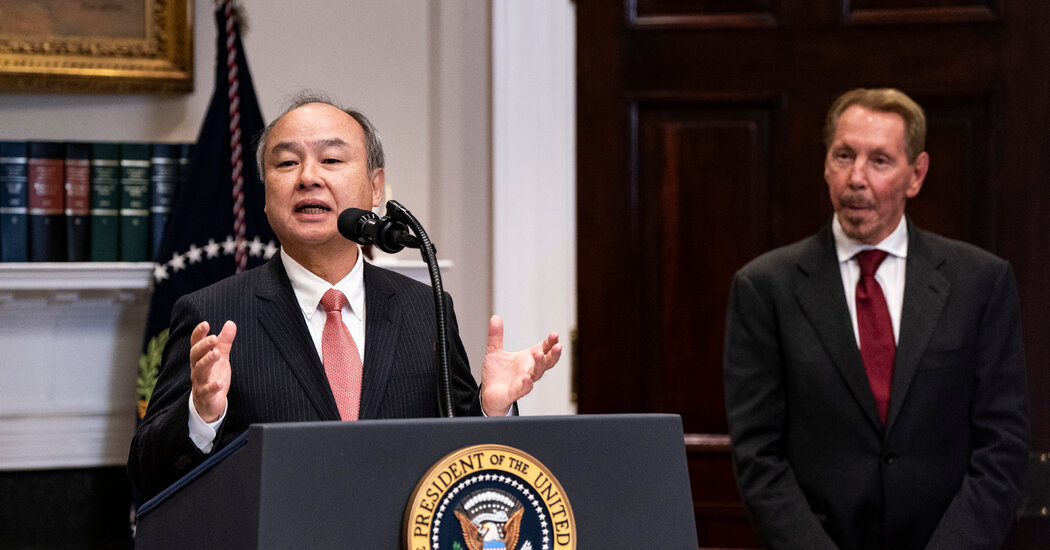

The Stargate Initiative

Earlier in January, Masayoshi Son, alongside notable tech leaders including OpenAI’s Sam Altman and Oracle’s Larry Ellison, announced the Stargate initiative, aiming to invest up to $500 billion to construct a network of data centers across the U.S. This endeavor marks SoftBank’s commitment to instrumental developments in artificial intelligence.

Market Dynamics and Processor Needs

As the demand for A.I. applications grows, the market for microprocessors designed specifically for these technologies is projected to swell. Research firm IDC estimates that the market for A.I. microprocessors will grow from $12.5 billion in 2025 to $33 billion by 2030.

Traditional players like Intel and Advanced Micro Devices (AMD) currently dominate the A.I. microprocessor market. However, Nvidia is pushing for the adoption of Arm processors to challenge this status quo. Companies such as Amazon, Google, and Microsoft have been more focused on developing proprietary microprocessors that leverage Arm technology, potentially sidelining startups like Ampere.

Ampere’s Innovation in Chip Design

Ampere recently announced a new chip named Aurora, which features up to 512 simplified calculating engines optimized for A.I. inferencing tasks. Led by Renée James, a former Intel executive, Ampere has made strides in the sector, securing investment and a customer base primarily through Oracle, which holds a significant stake in the company.

Oracle’s continued commitment to Ampere includes equity and debt investments, indicating a robust partnership. As part of the acquisition agreement, Oracle and the Carlyle Group, a private equity firm invested in Ampere, will divest their stakes.

Concluding Thoughts

The acquisition of Ampere by SoftBank is more than a financial transaction; it represents a significant shift in the landscape of semiconductor technology, specifically in the data center and A.I. sectors. As the industry continues to evolve, Ampere may play a critical role in shaping the future of computing power.