Intel’s Gamble: Partnering with TSMC to Reclaim Semiconductor Dominance

In the ever-evolving landscape of Silicon Valley, few companies have had as profound an impact as Intel. Once regarded as an unstoppable force in semiconductor manufacturing, Intel’s recent struggles have left it seeking a path to restoration. Now, in a bold strategic maneuver, Intel is reportedly working with the Trump administration to hand over the operations of its chip-making plants to a rival, Taiwan Semiconductor Manufacturing Company (TSMC), while separating its manufacturing and design divisions.

The Leadership Behind the Move

At the helm of this pivotal transition is Frank Yeary, Intel’s interim executive chairman. Yeary has spent recent months engaging in discussions with high-ranking officials from the Trump administration and leaders at TSMC. Insiders suggest that the core of the negotiation revolves around the drastic restructuring of Intel’s business model. By shifting control of its manufacturing operations to TSMC, Intel aims to refocus on its semiconductor design and product development, a necessity if the company hopes to remain relevant in a highly competitive market.

The Role of TSMC

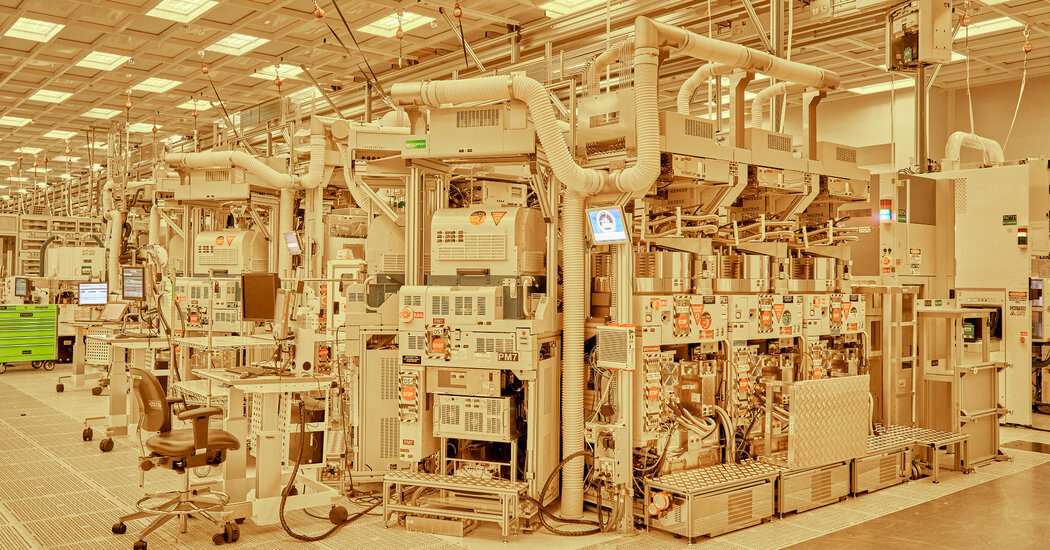

Taiwan Semiconductor Manufacturing Company stands as a titan in the semiconductor industry, responsible for a staggering 90% of the world’s most advanced chips. With an unrivaled capacity for chip production, TSMC’s involvement in Intel’s future could usher in a new era of innovation and efficiency. By taking control of Intel’s manufacturing unit, TSMC would not only gain access to Intel’s production facilities but would also assume a majority stake in this key segment of the once-mighty company. This strategic partnership could bolster TSMC’s already impressive portfolio and enhance its ability to serve a growing demand for sophisticated semiconductors.

Investor Interest and Financial Considerations

The intricate deal with TSMC is likely to attract a consortium of investors, including private equity firms and technology companies eager to participate in the semiconductor renaissance. This influx of investment could provide Intel the financial backing needed to innovate and reclaim its footing in the marketplace. The prospect of increased funding and resources could be crucial for Intel as it attempts to regain its pioneering status amid fierce competition from companies like AMD and Nvidia, who have rapidly gained ground in recent years.

Political Implications and Support from the Trump Administration

The timing of these discussions reflects a broader political narrative surrounding semiconductor manufacturing in the United States. The Trump administration has actively encouraged TSMC to engage in this transformative deal, viewing it as a pivotal step in reinforcing America’s standing in the global semiconductor supply chain. Howard Lutnick, nominated by Trump for the position of commerce secretary, is reportedly deeply engaged in the negotiations and sees the outcome as one of the most significant challenges of his tenure. The administration’s involvement adds a layer of complexity to the potential deal, intertwining business interests with national economic strategies aimed at safeguarding American technology leadership.

Challenges and Considerations Ahead

While the move to partner with TSMC may spark optimism among investors and stakeholders, the transition undoubtedly poses challenges. For one, separating the manufacturing business from Intel’s design operations requires meticulous planning and execution. Any disruption during this process could further complicate Intel’s efforts to regain market share. Additionally, the integration of TSMC’s practices with Intel’s legacy systems may present technical hurdles that will need to be addressed.

Furthermore, as global demand for semiconductors continues to rise, TSMC may face its challenges in scaling operations effectively to encompass the responsibilities it would assume under this partnership. Balancing existing commitments while ramping up production for Intel could strain resources in the short term.

The Future of Semiconductor Manufacturing in America

As these discussions evolve and the future of Intel unfolds, the semiconductor industry remains a focal point in America’s tech landscape. The outcome of this collaboration between Intel and TSMC could set a precedent for how traditional semiconductor manufacturers adapt to shifting market dynamics. It also underscores the critical need for agile strategies to maintain competitiveness in an increasingly globalized economy.

In sum, Intel’s bid to collaborate with TSMC amidst a changing political and economic environment highlights the ongoing struggle for dominance within the semiconductor sphere. With the stakes high for both companies and the national interest at play, this potential partnership may very well reshape the future of semiconductor manufacturing not just in America, but around the globe.